AS soon as President Marcos Jr. certified as urgent the legislation for the creation of the sovereign wealth fund, the House of Representatives sped up its passage. In just one day, House Bill No. 6608 didn’t go through the wringer, the usually tedious process of lawmaking. After the three-hour interpellation of Albay 1st District Rep. Edcel Lagman, the House voted 279 against six HB No. 6608 on third and final reading.

The ball is now in the court of the Senate to pass a similar bill.

What are the salient features of the SWF that the House has approved? Here are the highlights:

Name of SWF: Maharlika Investment Fund (not Maharlika Wealth Fund as reported earlier by other media)

Nature of MIF: Independent, adheres to principles of good governance, transparency, accountability

Investment body: Maharlika Investment Corporation, an “independent corporate body.”

Who owns the Fund: Legally, the “Fund investors in proportion to their contributions.”

Objectives of the Fund: “Generate consistent and stable investment returns with appropriate risk limits to preserve and enhance the long-term value of the Fund, obtain the optimal absolute return and achievable financial gains on its investments, and satisfy the requirements of liquidity, safety/security, and yield to ensure profitability.”

Who will lead the MIC: Finance Secretary as chairperson of the board of directors

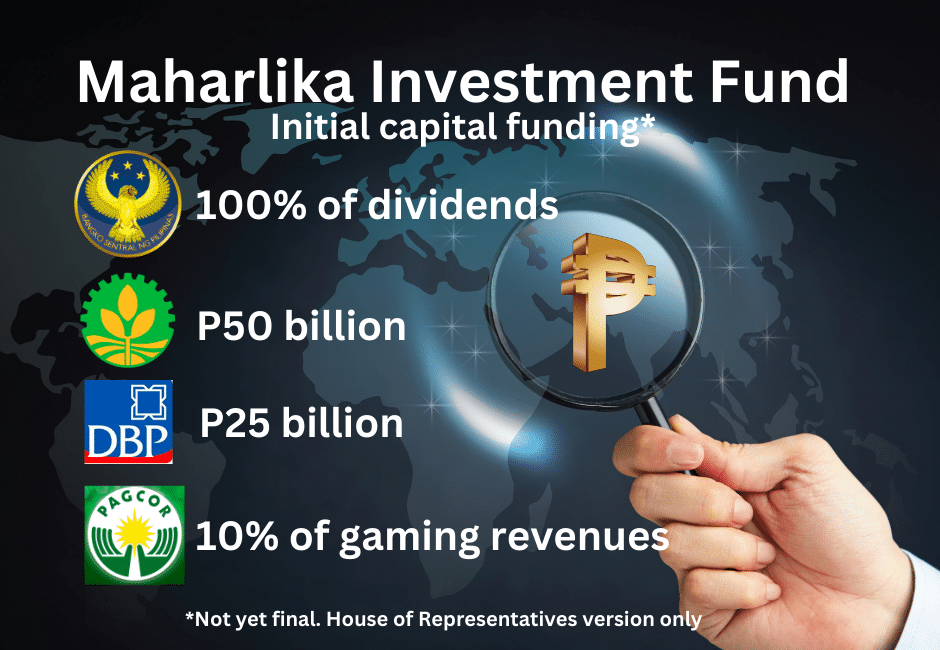

Where to get initial funding: Land Bank of the Philippines (P50 billion), Development Bank of the Philippines (P25 billion), Bangko Sentral ng Pilipinas (100% of dividends), Pagcor and other government-owned gaming operators (10% of gross gaming revenue), royalties and “or special assessments” on natural resources.

Special funding arrangement by BSP:

- 2nd year – 100% of declared dividends

- 3rd year onwards – 50% of declared dividends, the other half for the national treasury

- Until the increase of capitalization of BSP has been fully paid, thereafter, BSP shall remit 100 $ of its declared dividends to the Fund.

Where can MIC invest the funds:

- Cash, foreign currencies, metals, and other tradeable commodities;

- fixed income instruments issued by sovereigns, quasi-sovereigns, and supranational;

- domestic and foreign corporate bonds;

- listed or unlisted equities, whether common, preferred, or hybrids;

- Islamic investments, such as Sukuk bonds;

- Joint Ventures or Co-Investments;

- Mutual and Exchange-traded Funds invested in underlying assets;

- Commercial real estate and infrastructure projects

- Loans and guarantees to, or participation into joint ventures or consortiums with Filipino and foreign investors, whether in the majority or minority position in commercial, industrial, mining, agricultural, housing, energy, and other enterprises, which may be 27 necessary or contributory to the economic development of the country, or essential to the 28 public interest;

- and “other investments.”

Salaries of MIC employees: All employees, including executives, will be exempt from the Salary Standardization law, which sets the wages of government employees. Officers or key personnel of BSP, LandBank, or DBP may be hired in secondment, in which case they can continue to receive salaries and benefits from their agencies.

Selection of investment services: The procurement or engagement of professional or technical assistance that will help the MIC select the type of investments shall be exempted from the Government Procurement Act.

Remittance of earnings: The MIC shall also be excluded from the Dividend Law, which requires all GFIs to remit half of their income to the National Treasury. But under the House proposal, they must submit 25 percent of their income to the National Treasury for “social welfare projects.”

Accountability. Three bodies will audit the MIF: an internal auditor, an external auditor, and the Commission on Audit. Also, Congress shall form a Congressional Oversight Committee to monitor and evaluate the law’s implementation.

Penalty. Any director, trustee, or officer of the MIC who violates the investment policies, such as fraud or gross negligence, shall be punished with one- to five-year imprisonment or a fine of P50,000 to P2 million. The court will determine the penalty.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?