Confidence in government and stock market gains are inseparable.

Political optimism – the perceived ability to govern well – can translate to economic optimism and stock market gains. The converse is also true – stock market gains can be a sign of approval and confidence in the government.

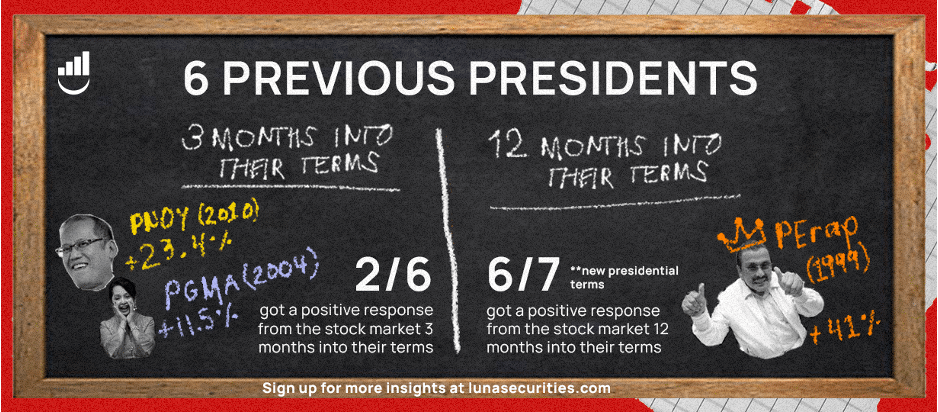

Looking across the six previous presidents from the start of their terms on June 30 (except PGMA in Jan 2001 and PCory in Feb 1986), only two out of the six presidents got a positive response from the stock market three months into their terms.

They are PNoy in 2010 with a gain of 23.4 percent, and PGMA in 2004 at +11.5 percent.

The picture changes however 12 months into their respective terms, as perceptions and conditions change, with six out of seven new presidential terms enjoying a positive response. PErap in 1999 ranked first at +41 percent, while lowest gain was with PRRD in 2017 at +0.4 percent. The thorn among this sea of plusses was during PGMA’s first term in 2001, where stocks fell 19 percent a year after she began.

Stocks have gained 14.4 percent in the seven months since PBBM took office in June last year. Given the pace, will PBBM be able to match the consistent stock market gains posted during Pnoy’s time? If so, then we are looking at another 13 percent gain in stocks in the next six months.

A steady and positive stock market is an important gauge of public sentiment and overall business confidence. Rising stock prices create instant wealth, and feeds into a positive consumer attitude to spend, invest in new enterprises, and expand businesses.

However, specific to the Philippines, where many citizens don’t own stocks – or any other assets to begin with – stock market performance is a superficial and unfelt indicator of success. Before congratulating themselves, leaders should reach beyond stock price headlines and look for the prices that really matter. Here at home, prices of onions cause more anxiety than the stock price of SM or Ayala.

Here at home, prices of onions cause more anxiety than the stock price of SM or Ayala.

Luna Securities

Post-pandemic and post-Ukraine, there are rough waters ahead. Beyond stocks and onions, top of mind is the record high levels of national debt – Php13.4 trillion or Php121,800 for every Pinoy man, woman and child. This record high debt gives very tight room for PBBM’s government to allocate funds for much needed social reform and development programs.

Ultimately, this debt must be paid, out of our pockets, from the various taxes and duties that we all pay to make the government run. In our estimate, if no new creative sources of income are found, the tax burden of the ordinary Filipino will have nowhere to go but up – higher income tax rate, higher VAT rate, new taxes on food, sugar drinks, gasoline, cars, etc. Lowering government expenses to generate savings could be a good start, but that seems to be an unconsidered concept in political circles nowadays. In the end, unrequited tax burdens will merely push Filipinos away to look for better opportunities elsewhere.

Debt, and the inability to pay for it, precipitated an economic crisis in 1981. The subsequent political turmoil emanated from that, and not the other way around.

So, while one eye is positively looking at stock gains and the good times it portends ahead, the other eye is firmly on the onion, hoping to avoid the tears that will inevitably flow when we must cut through it.

About Luna:

Luna Securities, Inc. is a member of the Philippine Stock Exchange. Their app, Luna, is a PSE certified, mobile-only, stock trading platform, the first cloud-based one in the country. Trading through Luna is easy-to-use, fast, secure, and convenient. To find out more, visit www.lunasecurities.com.